/cdn.vox-cdn.com/uploads/chorus_asset/file/22523848/1228692307.jpg)

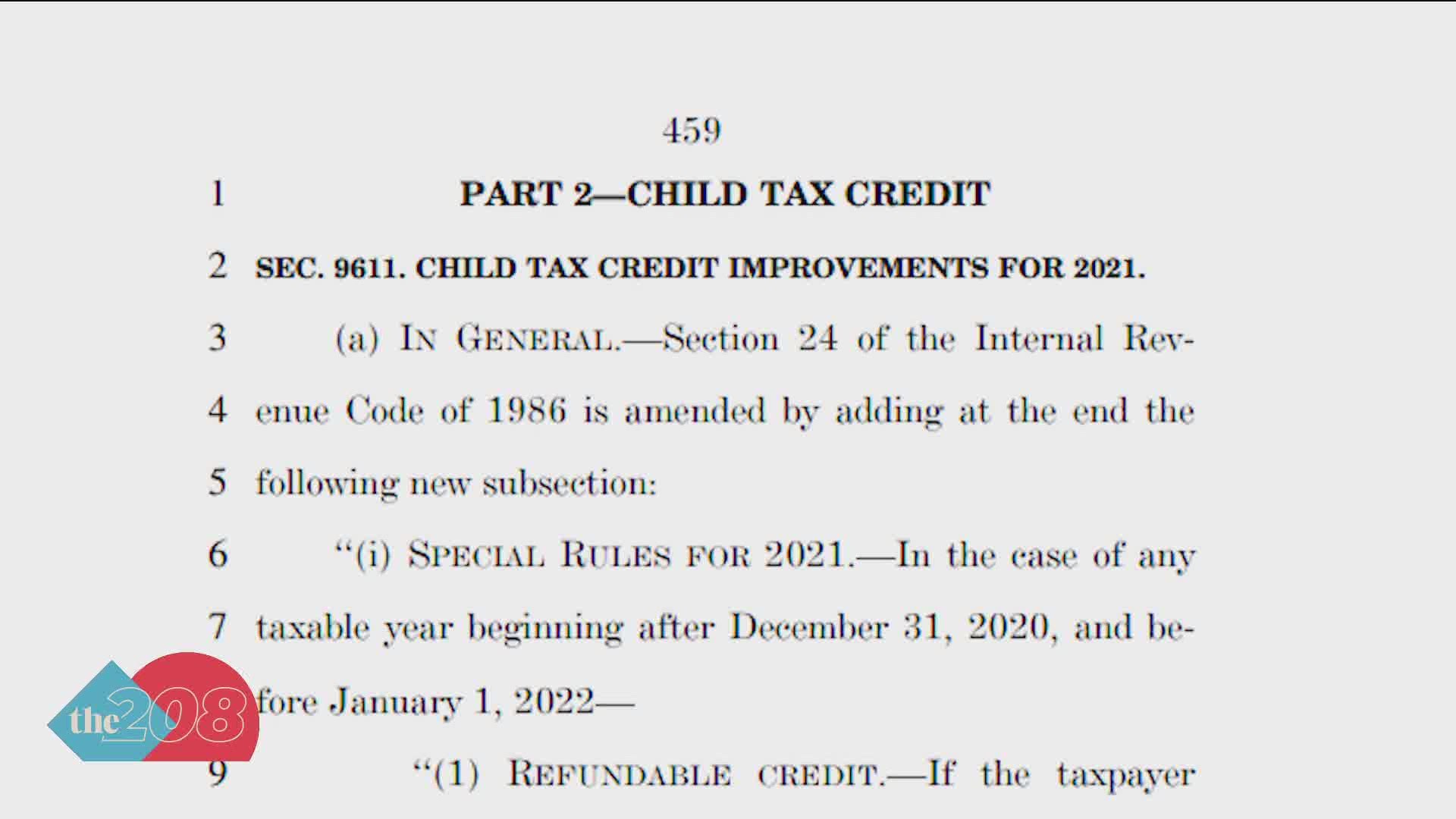

Tax credits income thresholds and withdrawal rates. Read on for an overview of the 2020 and 2021 child tax credit, including advice on how to get the maximum benefit from this tax break for your family. Treasury plans to start distributing payments, possibly on a monthly. Including 2021, from 2018 to 2015, the ctc amount is set to be $2,000. The child tax credit for 2021 introduces a new feature: You're only allowed to claim the credit if there are income limitations for those claiming the child tax credit. The child tax credit has doubled in recent years and increased its income limits. Here's what to know about qualifications before the irs sends out the advance payments. Unlike a nonrefundable tax credit, which can only bring your tax bill down to $0, a refundable credit such as the new version of the child tax credit can the irs will use your latest tax information to calculate your advance payments of your 2021 credit. Tax law changes affecting families in recent years have been a mixed bag.

Read on for an overview of the 2020 and 2021 child tax credit, including advice on how to get the maximum benefit from this tax break for your family. Including 2021, from 2018 to 2015, the ctc amount is set to be $2,000. Presently, the child tax credit is worth $2,000 per kid under the age of 17 whom you claim as a dependent and who has a social security number. That's the main takeaway of the changes implemented to the child tax credit (ctc) this year. The child tax credit will work differently in 2021 as well as see an increased amount.

Read on for an overview of the 2020 and 2021 child tax credit, including advice on how to get the maximum benefit from this tax break for your family.

The third stimulus package increases the amount of the credit, makes it fully refundable and paves the way for families to receive advance payments of the credit later this year. Part of the new child tax credit will be paid in monthly installments to families who filed a 2020 or 2019 tax return, beginning july 15. Taxpayers can receive direct advance payments of their child tax credits, in amounts of $250 or $300 per qualifying child depending on age. For working families with children, this tax cut sends a clear message: You could be eligible to receive the $2000 child tax credit. The child tax credit completely disappears if the taxable income is above $220,000 for single and $440,000 for joint filers. The hills are eligible for less money than the other families because they have a higher income. You're only allowed to claim the credit if there are income limitations for those claiming the child tax credit. How it's calculated, what the income limitations are (there are actually two different. The child tax credit will work differently in 2021 as well as see an increased amount. If your modified adjusted gross income, which includes just about every form of. The enhanced child tax credit (ctc) was signed into law by president joe biden as part of the american rescue plan. Help is here, said president joe biden in a monday statement. What if i have a baby in 2021?

Half of the tax credit will go out as monthly payments between july and december 2021. Part of this expansion is to advance the 2021 tax credit to families by sending them direct payments during 2021 rather than having them wait until they. The child tax credit has doubled in recent years and increased its income limits. $150,000 if married and filing a joint return.

Part of this expansion is to advance the 2021 tax credit to families by sending them direct payments during 2021 rather than having them wait until they.

The enhanced child tax credit (ctc) was signed into law by president joe biden as part of the american rescue plan. The child tax credit is also fully refundable, which means taxpayers can receive the entire credit even if they don't have. Here is what the child tax credit means for you, what the income limits are for 2020, and how it might change under president biden. What if i have a baby in 2021? How it's calculated, what the income limitations are (there are actually two different. Part of this expansion is to advance the 2021 tax credit to families by sending them direct payments during 2021 rather than having them wait until they. The boost to the child tax credit will give eligible parents a total of $3,600 for each child under 6 and $3,000 for each child under age 18 for 2021. How does it work for divorced parents? And in 2021, you may be able to get some of the child tax credit you are due sooner, in the form of monthly advance payments. The child tax credit completely disappears if the taxable income is above $220,000 for single and $440,000 for joint filers. Unlike a nonrefundable tax credit, which can only bring your tax bill down to $0, a refundable credit such as the new version of the child tax credit can the irs will use your latest tax information to calculate your advance payments of your 2021 credit.

What if i have a baby in 2021? The child tax credit isn't anything new, but it has gotten a major overhaul in the american rescue plan act of 2021. An aspect of fiscal policy. Half of the tax credit will go out as monthly payments between july and december 2021. The first phaseout can reduce a4.

Here's what to know about qualifications before the irs sends out the advance payments.

The boost to the child tax credit will give eligible parents a total of $3,600 for each child under 6 and $3,000 for each child under age 18 for 2021. Here is what the child tax credit means for you, what the income limits are for 2020, and how it might change under president biden. Including 2021, from 2018 to 2015, the ctc amount is set to be $2,000. The american rescue plan would temporarily expand the child tax credit for 2021. But if, say, you earn a lot more money in 2021. Tax credits income thresholds and withdrawal rates. 2021 child tax credit this year, the martins and the longs are eligible for the same $9,000 child tax credit. The crystallization of the child tax credit and what it can do to lift children and families out of poverty is extraordinary. The revamped child tax credit for 2021 is more generous than in previous years, expands eligibility and establishes partial distribution through advance payments starting july 15. Tax law changes affecting families in recent years have been a mixed bag. A child tax credit (ctc) is a tax credit for parents with dependent children given by various countries. You could be eligible to receive the $2000 child tax credit. As part of the march 2021 stimulus bill, the value of the credit as well as the age limit have been increased. And in 2021, you may be able to get some of the child tax credit you are due sooner, in the form of monthly advance payments. What if i have a baby in 2021?

The child tax credit begins to be reduced to $2,000 per child if your modified agi in 2021 exceeds: child tax credit. The child tax credit has helped millions of americans with the cost of raising children.

We've been talking about this for years. republicans said that since the credit was meant to reduce income taxes, it naturally favored families who earned enough to have a tax liability.

An aspect of fiscal policy.

You could be eligible to receive the $2000 child tax credit.

Changes to the child tax credit for 2021 include increased amounts and advanced payments.

An aspect of fiscal policy.

You're only allowed to claim the credit if there are income limitations for those claiming the child tax credit.

A child tax credit (ctc) is a tax credit for parents with dependent children given by various countries.

The tax cuts and jobs act of 2017 increased both the threshold and the value of the child tax credit.

For working families with children, this tax cut sends a clear message:

That could happen if, for example, your 2020 income during the pandemic qualified you for the enhanced ctc, but your 2021 income was higher and would disqualify you.

Thanks to the american rescue plan act of 2021 (american rescue plan), the credit amount is significantly increased for one year, and the.

The tax cuts and jobs act of 2017 increased both the threshold and the value of the child tax credit.

The child tax credit completely disappears if the taxable income is above $220,000 for single and $440,000 for joint filers.

The american rescue plan would temporarily expand the child tax credit for 2021.

As part of the march 2021 stimulus bill, the value of the credit as well as the age limit have been increased.

In 2021, the maximum enhanced child tax credit is $3,600 for children younger than age 6 and $3,000 for those between 6 and 17.

The irs will pay half the total credit amount in advance monthly payments beginning july 15.

You're only allowed to claim the credit if there are income limitations for those claiming the child tax credit.

That's the main takeaway of the changes implemented to the child tax credit (ctc) this year.

Part of this expansion is to advance the 2021 tax credit to families by sending them direct payments during 2021 rather than having them wait until they.

Half of the tax credit will go out as monthly payments between july and december 2021.

The child tax credit completely disappears if the taxable income is above $220,000 for single and $440,000 for joint filers.

The child tax credit isn't anything new, but it has gotten a major overhaul in the american rescue plan act of 2021.

The tca also increases and enhances the child tax credit (ctc) for children under age 17.

Child tax credit payments begin july 15.

This publication is licensed under the terms of the open government licence v3.0 except where otherwise stated.

The tax cuts and jobs act of 2017 increased both the threshold and the value of the child tax credit.

Child tax credit phase out — here's what we know it remains unclear if filers will be given the option to decline monthly payments and opt to take the full tax credit when filing their 2021 taxes.

Posting Komentar untuk "Child Tax Credit 2021 / 2021 Child Tax Credit What It Is How Much Who Qualifies Ally"